Our website is supported by our users and contains affiliate links. We get paid when you purchase or sign up for anything through those links. Read the full disclaimer for more information.

Last Updated on May 28, 2021 by Daniella

Side hustle to financial freedom – that’s the blog’s tag line. You might be wondering what do I exactly mean by that?

Without side hustling, my wife and I wouldn’t be thinking of a future of financial freedom in the first place.

I first started side hustling when I wasn’t able to increase my income at my first job right out of college. So I started doing other work on the side such as part-time jobs and freelancing.

At first, side hustling was a temporary attempt to get some extra cash for bills. I had an above-average amount of bills when compared to other 21/22-year-old women, fresh out of college. I had some past legal issues I was paying off (and other bills that came with that), car insurance to pay, student loans, rent and more.

I was also horrible with that extra money coming in. I spent it faster than I got it.

I was eventually able to increase my income throughout the last 8 years of my career. I’ve actually been able to triple it since that first salary at my first job as a web engineer back in 2012. But I don’t think I would have been able to without those first side hustles.

Side hustles were the gateway drug into my financial education. They were what got my gears going and researching ways to make more money. Through that, I found more online resources that eventually led me to look for other jobs to increase my income at work (I am an advocate for job-hopping to increase your salary, within reason).

Then I found resources that help you negotiate to raise your pay at your current job. At the time I was very unhappy with my job and was also thinking of entrepreneurship. That led me to read finance blogs and new concepts I had never thought of before, including how financial freedom was much more possible than I thought.

This blog is normally written from my perspective with referencing back to my wife Alexandra, our side hustles and our goals being from the “we” perspective.

Alexandra doesn’t usually have much involvement in writing any of the posts on here (besides the posts about eBay because she is an eBay genius). I am trying to persuade her into voicing her perspective more and maybe do more writing for the blog.

This time, I am going to include actual sections from her because this topic is very much a “we” thing. Plus: She is a better writer than me 🙂 .

Pin it for later!

Table of Contents

What is financial freedom?

Financial independence and financial freedom – Don’t those terms mean the same thing?

Yes, for the most part. Others may disagree with this. But to us, both of these concepts sort of strive for the same goal. They both mean having the means to choose what to do with your time. The “means” being money.

That money doesn’t come from being employed or depending on others. That money may have originally come from being employed though. It is what you chose to do with that money to optimize it (make it compound and grow down the line). That same money now works for you and your lifestyle so you don’t have to continue working for someone else to get through the day to day expenses.

Usually, the income in this situation is passive from things such as investments like dividends from stocks, bonds, etc, real estate, business ownership (with limited involvement), royalties and other assets that you build up over time.

You can certainly still work if you love to work. But in this scenario, you can leave at any time without financial worry.

Sounds a lot like retirement, doesn’t it? Well in the FIRE community, that is what they are going for. FIRE means Financial Independence Retire Early.

With the recent rise of the FIRE concept, many are striving to save enough money (and/or make enough money) to quit their jobs early and retire.

In this sense, financial independence is living independently of earned income and maintaining a pretty frugal lifestyle for the remainder of your years. However, not all FIRE journeys are created equally.

In my mind financial independence always gets me thinking of retirement.

And even though I contribute enough to my retirement accounts to officially “retire” before the age of 65 (as in I won’t be working at all), I am going for something else.

I don’t want to necessarily “retire”, I just want to be able to fully experience life on my terms (rather sooner than later). And yes, work is a part of those terms that I like experiencing (but optional work).

However, financial independence doesn’t mean retiring early. I don’t know why my mind always goes there. That is why I like thinking of it as financial freedom instead.

Financial freedom basically means that you have enough money to do what you want when you want to do it.

But how do you find how much money that is? Usually you can find your FI number by taking your annual expenses and multiplying by 25, but it isn’t a one size fits all approach and our number seems to always change as we grow and we change.

How We Got Here

I wasn’t good with money up until about the start of 2017. Basically, until I started this blog. There were a couple of years before that where I was getting better with money but it wasn’t until I started tracking my spending, debt payments, finding ways to optimize my money, etc that I really started to care about my financial future.

And then I got married and it wasn’t all about me anymore.

Alexandra was way better with money than me but we still would enable each other’s impulsive financial choices in the name of the spontaneity of a new relationship. 5 years together and 3 years of marriage later, we are on the same page.

We didn’t really talk about money much at the beginning of our relationship. But we weren’t so future-focused as we are now. And with focusing on the future comes talks of money.

We do very much try to live in the present (as much as possible, this can sometimes be a challenge though with day to day life and anxiety). That doesn’t mean that we can’t think of the future too.

Related posts: 7 Useless Things We Wasted Money On

Let’s Talk About Privilege for A Second

I didn’t come from rags or anything and I am an only child.

My mom is a nurse and my dad is a software engineer/architect. Growing up, they always had more than one job and did everything they could to give me the best life.

I never remember things being particularly hard for us. I went to private school my whole life (and an all-girls, blue-ribbon high school). They paid more than half my college tuition and I still had student loan debt but it wasn’t much.

I am half Venezuelan but I am also half “a bunch of other stuff” being Irish, German, etc (basically a white Latina). My dad came to America when he was 18, met my mom not too long after that and then the rest is history. He became an American citizen when I was still pretty young and worked his ass off (along with my mom) for the life they have now.

They are amazing people and I wish I listened to them more when I was younger about finance. They always joke about how I waited until my late 20s to start caring about finance. Let’s just say I was a mess in my teens.

But I 100% know I would not be where I am today in my life without them and what they have done for me.

I have heard others say it doesn’t matter where you came from and it is all up to you to form the kind of life you want. I disagree with that. It absolutely matters. A child growing up in a middle-class family in the American midwest has a better chance of reaching a certain level in their life than a child growing up in a third world country.

Alexandra’s father was also an immigrant, coming here from Mexico before meeting her mom and then become a U.S. citizen.

She also came from a hardworking family. She is 13 years older than me and is actually on her second career now (her first being a mechanic and her second in I.T.). I believe she had to work a lot harder than me to where she has gotten to today. But there is a little unknown thing about her that she fights with every day and that is the treatment she gets from others for being transgender.

If you aren’t already aware, there are a lot of challenges transgender people face including harassment, barriers to healthcare, employment rights, identity documents, lack of legal protection and many other rights violations (M to write a follow-up article to this soon).

She is a rockstar and my hero.

Our Ideal Life

Our ideal life will likely change over the years as our interests shift and what makes us happy may change. We do not have any kids nor plan to so we won’t have to plan for that and their futures.

We will still make animals a big part of our life. With our current mini zoo of 5 cats, 2 dogs, and a couple of tarantulas in a house that is under 1,000 sq ft, it would be nice to purchase land where we could expand our fur family. We hope to one day open a small sanctuary for elderly and disabled cats and dogs (and any that won’t get adopted).

We would probably build our own house on that land and would want to make it as sustainable as possible (and affordable). We wouldn’t be living close to a large city as we do now and would want to head west (closer to the coast, the better).

We also want the freedom to be able to travel whenever we want, wherever we want. Travel has always been an important thing for us but has proved difficult with our pets. Maybe we could source some volunteers or outside help to tend to the small sanctuary and our pets when we want to hop on a getaway.

By this time we would have most of our income flow passively through multiple sources that we are currently working on building up to one day be self-sustaining (for the most part). If we need to, we have no problem with working part-time.

One thing I have always wanted to do though is run our own little Airbnb. It would either be a small detached “tiny house” on our land or a yurt. Either way, we will also try and build this ourselves.

We don’t have every detail of it pinned down yet and we don’t have to.. but we are getting there. Every day we learn something new that sways us in a new direction of our ideal life and that is what makes it so exciting – it being such a learning experience.

Related post: 19 Passive Income Ideas to Stop Trading Time for Money

How My Wife Alexandra Puts It (Oh So Eloquently)

Essentially, financial freedom fits into our “ideal life” as an undetermined promissory note… this means, we’re writing ourselves a check and haven’t put an amount on it yet. We know we’re going to get it, store it and one day need it for goods and services as we would any other paycheck from a regular 9-5 job.

But, we don’t need a 9-5 job to tell us under what circumstances to write that note. At least, we perform our daily tasks at our own volition instead of that 9-5 being an actual “9-5”. It can be a “12pm-4pm” or “Mon to Wed”, just something to perhaps pick up insurance or 401k with a match.

We will lend ourselves time to live our best lives as we see fit, instead of just day-to-day or as a corporate life would otherwise dictate the best guest approach to when you’re allowed vacation and a full weekend away from on-call, especially in the I.T. realm as my wife and I.

In order for us to take hold of our dreams of being free to take in and take care of unfortunate animals, or travel to the most beautiful places this planet has to offer before it’s gone or experience an experience we never thought possible – we have the opportunity to do so by molding our own future and discovering our own talents.

I personally feel at my age I’m approaching this at “never too late”, because I’ve gone through years of the 9-5, I’ve surpassed the time it’s taken to purchase a home, a car, build up retirement accounts and bank accounts… but that’s also helped me see that it’s not as easy as just speaking the language, it takes hard work, lots of it!

Giving Back

Another huge part of our ideal life will be the ability to give back to the systems that made it possible for us to get to where we are in the first place. This could be through volunteer work of our actual time or with money.

We already actively give about $50 a month to various charities and volunteer through various programs that the company I work for arranges.

But we could be giving and doing more.

When we have more to give, we would love to donate to charities that help women and children, specifically abused women and children and charities that help refugees and immigrants.

Alexandra had this amazing idea: If each consumer in any given community donated 1 item a week to their local pantry, each of those needy families would have (most) of their needs met.

This is something we would also continue to do – to donate to the local pantries in our community and local non-profits, no matter where “local” is for us.

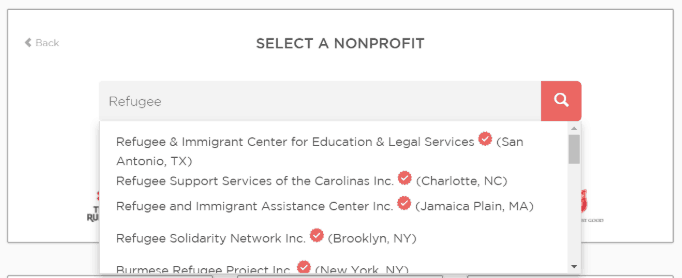

I love using the Giving Assistant for shopping online and getting cash back that I can then opt to donate to any charity of our choice.

To opt for what charity to support when giving your cashback earnings on Giving Assistant, you can choose from their database that includes basically every charity I have heard of. When you sign up through my link, you will be prompted to give back to my charity of choice (but you can change that charity as shown in the screenshot below).

Note: I donate 100% of cashback earnings on Giving Assistant. So if you click through my link and sign up, we both receive $5 and that $5 on my end will go towards RAICES. RAICES (Refugee & Immigrant Center for Educations & Legal Services) is a 501(c)(3) nonprofit agency that provides free and low-cost legal services to underserved immigrant children, families, and refugees. Learn more about RAICES here.

Dosh is another great cashback app that lets you opt to donate your cashback earnings.

How We Are Doing It

Some ways we are trying to set ourselves up for this future we are envisioning:

- Investing in multiple retirement accounts (currently 40% of our combined income into my 401k & IRA and M’s 401k & IRA)

- Started contributing more towards our HSA when we can

- Investing outside of retirement in stocks using M1 Finance (check out our full review of the app)

- We currently keep 6 months of expenses in our emergency fund.

- We have a separate fund for that land + house we were talking about and still actively saving towards that.

- Paid off all of our debt besides our car and house (car has about $18,000 left and the house has about $50,000 left unless we sell it before we pay it off, which is our plan)

- Running our small side businesses in our spare time and putting that extra money earned back into the side businesses and our outside investments (building up passive income streams)

- Trying to decrease our expenses anywhere we can (within reason), including bills. An example of this is when we called our auto insurance provider to see if we could renegotiate our rate. We were told they couldn’t go any lower so I looked at other providers and found Geico. I was able to nail down $98.66 a month for 2 cars (one with full coverage and the other liability only because it is old as hell) and 2 drivers (and one of those drivers has a pretty bad driving history..*cough* – it’s me). That saved us $150 a month on car insurance. Yes, I know that sounds like the commercial but I am still pretty excited about it. Note: In our ideal life, we will only have 1 car. We actually always had 1 car until I had to get a job where I have to drive to an office half the week that is in the opposite direction of where Alexandra works currently. But as our situations change, our requirements will also change.

- Researching and trying out more passive income ideas to build up additional streams of passive income

- Steering clear of lifestyle inflation as our incomes increase

- Researching areas we want to move to in the future, how we would build our future home, how would everything work, etc

- Researching and reading books (like some of my recent favorites Work Optional and Financial Freedom) on how others have achieved financial independence and financial freedom

- Participating in online groups and forums where others have similar goals (like the Women’s Personal Finance Facebook Group and our own Save and Side Hustle Facebook Group)

- And literally trying to learn as much as we can every day (always learning new skills)

Tools we are using to help us along the way:

- We didn’t get into investing outside of our retirement accounts until the beginning of this year. I came across an extremely helpful robo-advisor/brokerage service called M1 Finance that made everything very easy for us. With M1 you can browse through pre-built portfolios and trade stocks for free. Yes, there are no fees!

- Personal Capital has been amazing for syncing up all of our accounts in one place. It tracks our spending, saving, investments, debt, everything in one place and is 100% free (no hidden fees).

- We use Trim to help us lower a couple of monthly bills, mainly our cell phone and WiFi bills. Last year Trim saved us a little over $200 on our At&t bill. This year since we switched to Verizon, Trim was able to save us $30 on that bill and $240 on our Charter bill. So Trim has saved us $270 dollars in total this year!

- We’ve used Digit in the past to set up automatic savings. Digit is an automated savings app that automatically saves money for us based on our spending habits and scheduled bills. We saved over $2,000 with Digit alone. But now set up automatic savings with our bank (most banks do this so you can also check with your bank to do the same).

Wrapping Up Our Thoughts

It’s not about never working again. It’s more about reinventing the way we think about work and how it fits into our ideal life. Of course, what that looks like may change and things will happen.

We don’t have kids to plan for but we (will) have elderly parents and medical expenses that are recurring monthly (plus the animals). There are things we will definitely have to worry about but we are prepared for the ride.

Finance is a daily job. It is something you have to pay attention to and stay on top of. Even though we are still very new into this journey, we are prepared for the work it requires.

Like Alexandra noted above, it isn’t going to be easy. But what in life is really “easy”?

Personally, we are excited.

What does financial freedom mean to you and what does that look like for you? We would love to hear from you in the comments below!

Subscribe to get your free list of side hustles you can start this week!

Claim your free list of side hustles + tons of helpful resources to get started!

Related posts: 35 Best Side Hustle Ideas

The Best Side Hustle for Your Zodiac Sign

Why Rushing Debt Payoff Isn’t The Answer

How Much Does It Really Cost to Own a Pet?

New Retirees: How to Live on a Fixed Income in Retirement

Frugal Living: 26 Tips to Live Big on a Small Budget

Money Saving Challenge: Save $1,000 in 10 Weeks

Daniella is the creator and author of iliketodabble.com. When their wife Alexandra and them aren’t globetrotting or playing with their 7+ animals, they are dabbling and working towards a future of financial freedom.

I love that your financial independence journey already includes giving to charity! RAICES is a great organization and even more important in this day and age. I enjoyed these thoughtful reflections on the ways you’re approaching FIRE.

Thanks! I am glad you enjoyed the post! What other charities do you like to give to?

Great post! I love the idea of everyone donating one item a week to a local pantry. Such a small gesture would make a big impact in helping those who need it.

Glad you enjoyed it, Ana!