Our website is supported by our users and contains affiliate links. We get paid when you purchase or sign up for anything through those links. Read the full disclaimer for more information.

Last Updated on November 30, 2020 by Yovana

This is a sponsored post from Better. All opinions are my own. I also took to twitter to discuss with other freelancers their tips on the subject so you will see their quotes below when referenced.

For a freelancer, time is money.

But not all your time should be taken up with work and increasing your profitability. I am sure you want a life too.

Having said that, pricing your work in your freelance business accordingly is an absolute MUST. Especially come tax time.

Self-employment is an entirely different ball game of unique tax responsibilities.

If you are a new freelancer, this might seem overwhelming at first. This is because you are thinking of it all at once. Take it step by step and think about each step at a time.

I promise it is a lot easier than you are making it out to be in your head.

Pin it for later!

Table of Contents

Calculate Freelance Hourly Rate

First, determine everything that goes into your hourly rate:

- Annual income or how much yearly profit you want to make

- Annual expenses including cost of doing business and cost of living (this includes self-employment tax and income tax)

- How much you want to work (a.k.a. billable hours)

- Admin work needed outside of billable work

Annual Income and Expenses

Your hourly rate isn’t necessarily based on how much experience you have, but rather your output and the quality of that output.

If you produce high-quality work (which I am sure you do), your prices better reflect that. Hey, we all gotta eat (and we need money to eat). Don’t sell yourself short.

What do you want your annual income to be? Write that down.

Then take into consideration the following expenses for the cost of doing business. Write them down and if it applies, write down the cost as well:

- Office space

- Web host

- Internet

- Invoicing and accounting software

- Project management tools

- Phone

- Laptop

- Marketing

- Education and certifications

- Other needed software to do your job like Adobe Create Suite, etc

- Backup fund for late payments from clients

- A separate fund for any travel or transportation costs

- Accountant fees and tax preparation fees

Then write down your cost of living expenses:

- Healthcare costs

- Self-employment tax

- Income tax

There could be more costs that you might face in your self-employment than what is listed above. K. Wright, a fellow freelance writer and creator of Money The Wright Way, recommends this article when figuring these costs.

If you earn more than $400 from freelance work in a year, you are required to pay the self-employment tax of 15.3%. Included in that are Social Security and Medicare taxes.

Remember, that is in addition to income tax. You’re probably looking at around 30% total in taxes that you will owe every year.

I basically just keep in mind that 30% comes right off the top so my rate needs to make the gig worthwhile with that factored in.

– Laura, fellow freelancer and creator of Every Day by The Lake

Take those total costs and add it to your annual income. That is your new adjusted income.

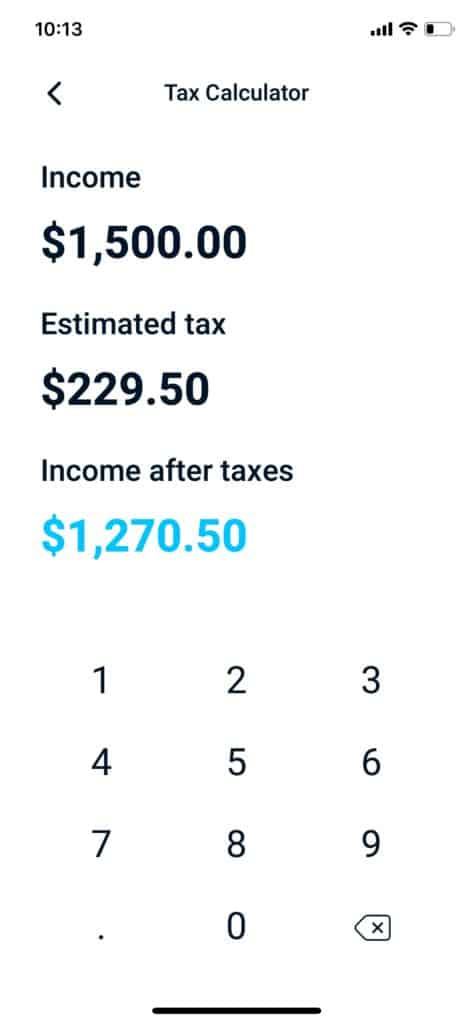

Tax Calculator

I used Better to use their simple tax calculator where I entered a recent freelance payment that I received to see how much tax I might owe on that. According to the app, there is $230 of estimated tax on a $1,500 payment. After taxes, I made $1,270.50.

Better is an app where you can link up your bank account to the app and the app will automatically determine which payments are freelance income and estimate your yearly taxes owed. Their freelance tax calculator to use on the go is a nice added perk to figuring out what you really should be charging per hour or per job.

The IRS says you should pay taxes quarterly if you are an independent contractor and expect to owe at least $1,000 in taxes in a year. If you want to avoid penalties, I suggest you do so (even if you freelance as a side hustle and it isn’t your full-time gig).

You can do this with the Better app. Setting aside money into your “My Tax Account” allows them to pay taxes on your behalf, ensuring on time payments.

What about tax deductions?

As a freelancer, you are allowed to take deductions necessary for the operation of your business. You want to reduce your tax liability to the lowest allowable amount.

This will help offset the increase of taxes required from you when going from a full-time employee to self-employment.

Here are some of the categories you can expect to write off as deductible expenses:

- Business-related food

- Travel lodging

- Office expenses

- Required equipment/materials

Anything in those categories are fair game, within reason. These would include:

- A home office (including wifi only for that home office, software used to run your business, etc)

- Equipment and supplies

- Travel and meals

- Any mileage used related to your business

- Education, certifications, training, etc

To avoid problems with the IRS, try as much as possible to keep your personal expenses separate from your business expenses. This might mean having separate wifi you use for your home office or separate phone service (maybe Skype).

Once you get it all organized and separated appropriately, it isn’t too hard to manage from there.

Related posts: 13 Smart Ways to Use Your Tax Refund

Entrepreneur Stories: Why One Woman Left Her Job to Start A New Chapter in Her Life

Remote Jobs That Pay More Than $15 Hourly

How much do you want to work?

Determining how much you want to work is important to be able to hit that adjusted income amount. Basically, what will be your yearly billable hours?

Let’s start with the average number of 8 working hours in a day and 5 days a week. If you want to work full time, there are 52 weeks in a year so that gives you a total of 2,080 billable hours a year.

Then figure in how many holidays you will be off (there are 10 federal holidays in the U.S. in a year), how much vacation (I am thinking 4 weeks or 20 days), 5 sick days and 5 personal days. These numbers could be totally different for you but I am using them for an example.

That would be a total of 320 hours. Subtract that from 2,080 and you get a total of 1,760 billable hours.

And that doesn’t include admin work. If you spent 25% of your time on billable work, multiply that by 1,760.

1,760 .75 = 1,320 billable hours

Now, divide your annual adjusted income by 1,320 billable hours and you get the hourly rate that you should be charging for your freelance work.

Calculate Project Rate

For certain freelance services you might offer, write each separate one down. Then write down how many hours it may take to complete that service or deliverable and add in any additional times for revisions.

Maybe your service includes documentation or extra support so figure that hourly work into the price.

Someone could hire you to design a logo that takes you 2 hours to create. But all they want is the logo. Plain and simple. Nothing extra.

Or someone wants a logo but 3 different versions of the logo with 3 different color schemes.

You can charge a fixed price for that.

Instead of charging $75 an hour for 2 hours of 1 logo design you charge them essentially the same rate but for the amount of 3 logos and price the variant color schemes accordingly. In theory, you would charge them a fixed price of around $450.

This route might be better for you depending on the type of freelancing services you offer. For designers, it is great because that first logo project might lead your new clients to purchase an entire branding package. You could make a lot more with project-based rates than hourly rates in this example.

Continually Increase Your Income

I spoke with BlackFreelance on Twitter and they recommended Ed Gandia’s Commercial Writing Guide.

I heard of Ed Gandia before but never really looked into his resources. Well, this time I did and I was blown away by the amount of resources he has for increasing potential clients and increasing your income as a freelancer.

Of course with increasing your freelance rate means more taxes owed. Even though you are still looking at around 30% for your total taxes owed, when you double your income you will double the taxes you owe (unless you can offset those with deductions, lowering your taxable income via retirement contributions, etc).

As long as you are paying quarterly, you should be fine.

In Conclusion

Doing your taxes as a freelancer can be difficult but they don’t have to be. Just because they are different than what you normally do with your employed taxable income, doesn’t mean they are necessarily difficult.

Being able to effectively track all your freelance and self-employed income (and expenses) is important. That is why I recommend Better.

Better is not only helpful because of the easy to use tax calculator they provide in the app, but you can also track your income and the taxes you owe on that income throughout the year. Better will also auto-send your quarterly taxes.

To learn more about Better, check them out here.

What other ways have you struggled with your freelance income taxes before? Any other tips for self-employed taxes that you don’t see in this post? Let us know in the comments below!

Related posts: Entrepreneur Stories: I Bought My First Business When I Was 25

Blogging as a Side Hustle: Mid Year Blog Checkin, Income, Redesign & More

31 Best Work From Home Jobs Hiring Today

The Best Places in Europe to be Self-Employed

Get The Monthly Money Mashup

The last Friday of every month I send an email consisting of my favorite posts throughout the financial community, money-related news that helps you, helpful resources, tips, opportunities for free stuff like any giveaways going on, and more!

Daniella is the creator and author of iliketodabble.com. When their wife Alexandra and them aren’t globetrotting or playing with their 7+ animals, they are dabbling and working towards a future of financial freedom.