Our website is supported by our users and contains affiliate links. We get paid when you purchase or sign up for anything through those links. Read the full disclaimer for more information.

Last Updated on November 30, 2020 by Yovana

I have been browsing many different financial and budgeting apps lately in an attempt to find something that gave me more of a full picture of my finances.

You have probably heard of or used most of the same ones I have. They are becoming quite the “thing”.

YNAB (You Need A Budget) is for budgeting, Acorns is for investing and Digit is for automating savings. I wanted something that included all of that in one, and then some.

Then I heard of the Clarity Money app.

So I thought I would do a Clarity Money review and see what all the hype was about.

Pin it for later!

Table of Contents

What is Clarity Money?

Clarity Money is a personal finance app available for both Android and iPhone. The app looks at your financial picture, as a whole, and provides insights to you based on that picture.

These insights are meant to aid you in saving money and making better financial decisions.

What does Clarity Money do?

After downloading Clarity Money, you will be asked to register. Then verify your email, set a secure Personal Identification Number (PIN) and link your bank account.

Once you link your main checking account, link any other financial institutions that you have accounts with to the app. Then the Clarity Money app takes that information and provides you insights through machine learning for an all-in-one money management dashboard.

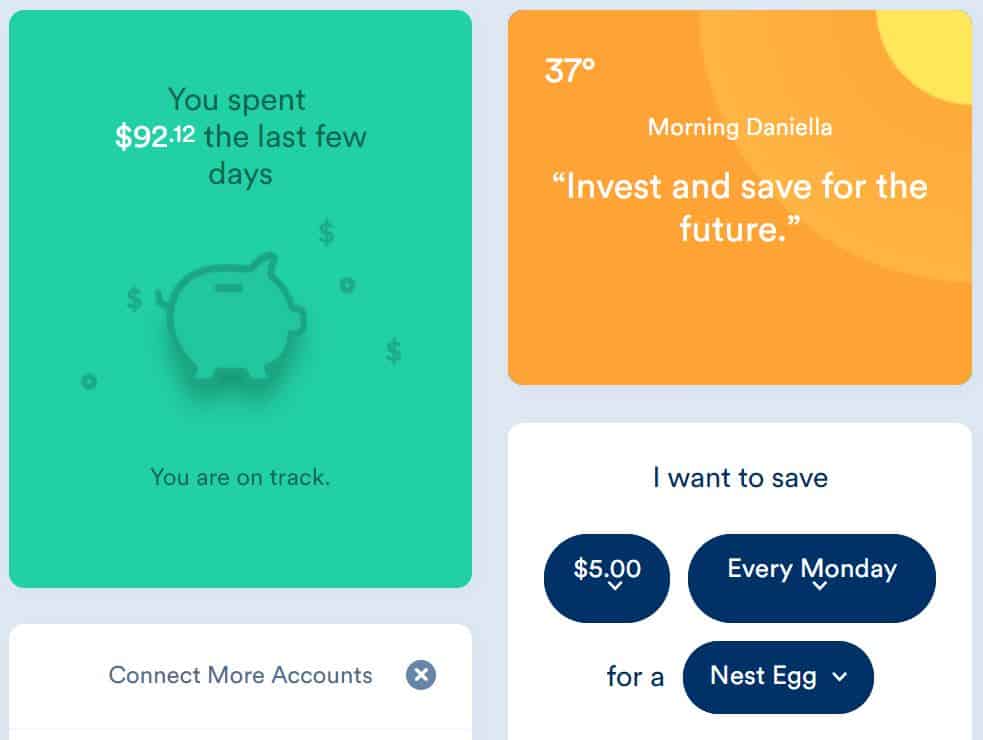

After you have all of your financial accounts linked, you will be able to see various modules in your app’s dashboard, including:

- The local weather + an inspirational quote

- Accounts and their balances (with the function of being able to easily transfer money between accounts)

- How much you spent in the last couple of days

- All transactions

- A prompt to automate savings

- Income for the current month

- How much you’ve spent of your monthly income and how much remains

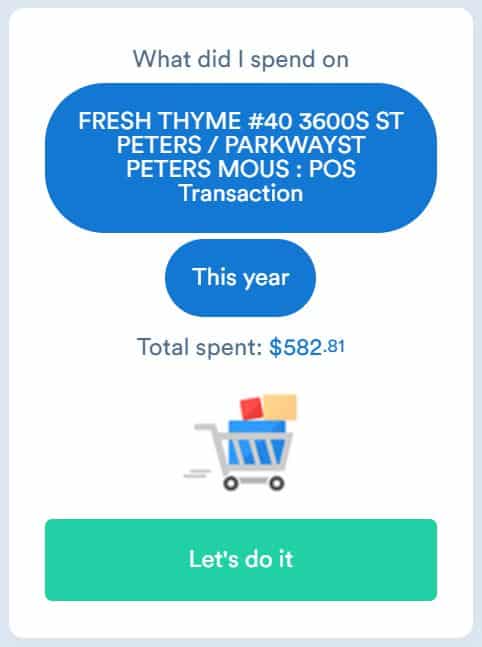

- A snapshot of what you spent during a certain time frame based on a specific selection (I selected a grocery store we often visit called Fresh Thyme to see how much I’ve spent so far this year. My module states I’ve spent $582.81 at Fresh Thyme in 2019 and this was written on March 18th, 2019.)

- Monthly spending per category

- Automatic Acorns integration to view your Acorns account

- Recurring Expenses

- All active monthly subscriptions and the option to cancel them

- Free credit score and monitoring

- An option to invite friends

- Further instruction on how the app works with a nice “Thank You”

Related posts: How to Create a Budget When You Are Horrible With Money

Dosh Review: Should You Link Your Card?

Can Clarity Money be trusted?

You are probably wondering – Is it safe to link my financial accounts to this app? Well, let’s review their secure features.

No Screenshots Allowed

Most of the screenshots of the app that I included in this post are actually from the desktop version of the app. This is because the mobile app actually restricts you from performing screenshots within the app.

I actually didn’t know mobile apps could restrict the user from screenshots but love the secure function.

In case you also didn’t know that apps could restrict you from screenshots, give it a try on Clarity Money by performing a screen sot on your phone, while in the app. You will see the following message pop up: “Can’t screen shot due to security policy.”

I did some research and actually found that most banking apps and financial apps use FLAG_SECURE for safety reasons, so that the screen can not be captured or recorded.

You might see other online reviews showing screen shots of the mobile app. I am not sure how they got these but maybe it was before the recent updates.

Personal Identification Number (PIN)

Like most other financial apps, there is the secure function of having to enter your 4 digit Personal Identification Number (PIN) every time you launch the app.

Establishing a PIN verifies your identity so any passer-by that gets a hold of your device won’t be able to get instant access to all of your information.

I have used the app for several weeks now and can say you can definitely trust it. If you are itching to know more, read the full Privacy Policy.

How much does Clarity Money cost?

Clarity Money is 100% free to download and use.

They are able to do this because of the offers you see in the app.

Clarity Money is able to make money when you sign up for any of their recommendations including credit cards, Acorns, or their 2.25% APY Savings Accounts provided through Marcus by Goldman Sachs (both the app and Marcus are brands of Goldman Sachs Bank USA).

Related posts: Money Saving Challenge: Save $1,000 in 10 Weeks

7 Useless Things We Wasted Money On

What I Love About It

Clarity Money is pretty great at providing the whole financial picture. It is safe to say there is a lot I love about this app.

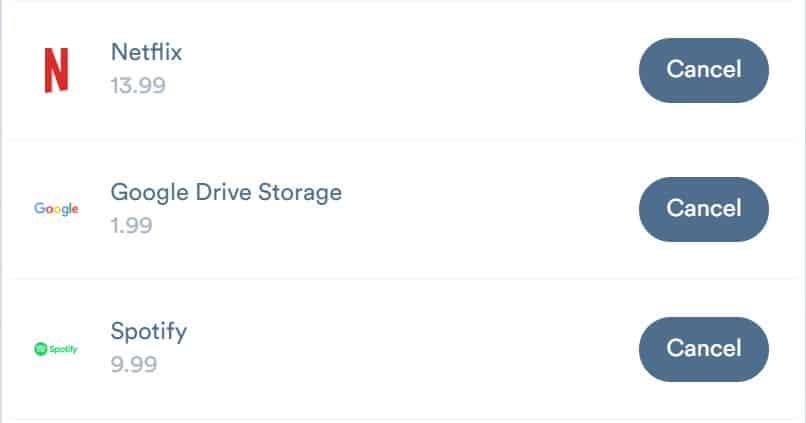

End Subscriptions Directly from The App

My favorite feature of Clarity Money is how easy it is for you to end any monthly recurring subscription you have, directly from the app!

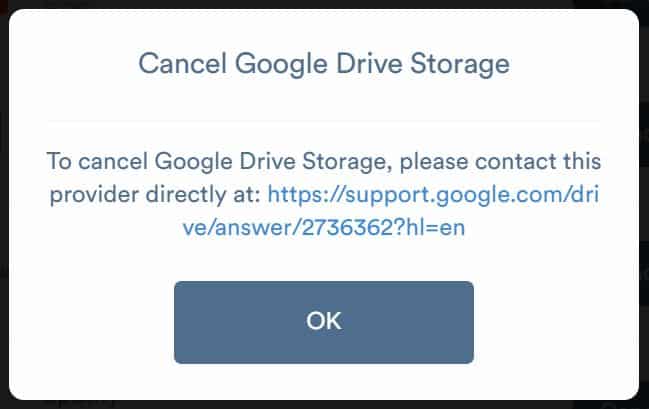

By clicking the subscription module, you will see a more in depth view of the subscriptions you currently have. To the right of each subscription, you will see an option to cancel it.

As you can see by the screenshot, Clarity Money does not cancel the subscription for you. Instead they give you the instructions of where you need to go to cancel them. This function is still great though because you can view all of your subscriptions in one place and manage your recurring expenses.

Check Your Credit Score Directly from The App

Rather than downloading a separate app to check your credit, you can check your credit score directly from the Clarity Money app.

It is completely free to check your credit through the app and does not hurt your credit score.

The Automated Savings Feature

Last but not least, is the automated savings feature. You can set up automatic recurring transfers into a 2.25% APY Marcus Savings Account directly through the Clarity Money app.

You can set recurring savings amounts of anywhere between $5 to $1,000 daily, weekly or monthly for a variety of savings categories including:

- Baby

- New Car

- Wedding

- Nest Egg

- Rainy Day

- Trip

- House

What I Don’t Love About It

Even though I love most of the features of Clarity Money, there are a few that I think could use some work.

There Isn’t a Way to Customize Your Monthly Budget

The app does show you in various ways of how much you are spending per month and how much you are making per month.

It is more of like an automatic view into what your current budget is but it doesn’t give you an option to create a new budget to work towards or customize any of the budget and spending categories.

Where is the net worth?

Clarity Money seems to show you every piece of your financial situation besides your net worth. I think this feature is crucial in order for this app to succeed.

If you have heard of or used the app Personal Capital before, you know exactly what I am talking about. Personal Capital can do almost everything that Clarity Money can do but it also tracks your net worth.

I am anxious to see if Clarity Money will be adding net worth as a feature in the future. I guess we will have to wait and see.

Where are the rewards features?

Out of everything that this app has included in it, I thought almost for sure that they would also include rewards features. By that I mean, the ability to reward you with cash back percentages for purchases you make with your linked accounts (kind of like Dosh or Ibotta).

Clarity Money is still very new though, being created in 2017. So this may be a feature that they just have yet to release yet.

Related posts: InboxDollars Review: What Happened When We Tried It

5 Simple Steps to Get Your Finances on Track

Key Takeaways

There are more pros than cons with using Clarity Money. However, if you are already using a budgeting app, you probably don’t need to use Clarity Money as you will see a lot of the same data.

But if you are on the lookout for the perfect budgeting app with automated savings built in, free credit checks, ability to view subscriptions and cancel them, and view your all-in-one financial picture, Clarity Money is for you.

I say, it is worth it to give it a try!

Download and sign up for Clarity Money here!

Other Apps Like Clarity Money

If Clarity Money sounds great to you but just isn’t what you need for your specific financial situation, there are tons of apps similar to Clarity Money for you to try:

- Personal Capital: The one thing Clarity Money is missing is the ability to show you your net worth. That is why I love Personal Capital because you can track your debt, spending and net worth all-in-one. With their award winning financial tools you can look at all your accounts in one place as well as plan for retirement and see how your investments are doing with their Investment Checkup.

- Digit: Digit is an automated savings app that automatically saves money for me based on my spending habits and scheduled bills. I have saved over $2,000 with Digit alone. This unsettles some people that an app has access to their money like that but it uses 256-bit encryption so I know my data is secure.

- Acorns: Acorns invests your spare change for you, making your beginner investments almost effortless. Use “Roundups” and “Found Money’ along with many more features on the app for maximum investing power. Register for Acorns with this link and get a $5 bonus to start investing with!

Related posts: Sweatcoin Review: Is It a Scam or a Legit Way to Get Paid to Walk?

Steady App Review: 10 Side Hustles That You Can Do Through The Steady App

Qmee Review: Can You Really Earn Instant Cash?

Have you tried Clarity Money before? What was your experience with the app? What other money apps do you use and love? Tell us in the comments below!

Sign up to get your free budget planner!

Effectively manage your finances and grow your savings.

Daniella is the creator and author of iliketodabble.com. When their wife Alexandra and them aren’t globetrotting or playing with their 7+ animals, they are dabbling and working towards a future of financial freedom.