Our website is supported by our users and contains affiliate links. We get paid when you purchase or sign up for anything through those links. Read the full disclaimer for more information.

Last Updated on February 6, 2024 by Daniella

When I asked Lunafi if they would like to sponsor this post, they happily agreed! All opinions are our own, as always, to make sure you make the most of your side hustle finances.

Taxes can be such a headache, especially when you have a side hustle.

Just thinking of taxes stresses me out.

For the folks that don’t know, yes – you’re absolutely responsible for paying taxes on your side hustle income. Income is income in America, and all income is taxed. According to the IRS, you’re required to file a tax return if you’ve earned $400 or more in a given year from self-employment.

You’d think by now the IRS would be able to tell us exactly how much we owe or are getting in tax refunds from the income data that they already have. But no, we continue to play this tax guessing game since the IRS released the first income tax form called Form 1040 in 1914. We still use that same form today, just versions later.

That first year was actually a test run and congress knew as soon as 1915 that they had concerns about how complex it was. Yet, here we still are over 100 years later fiddling around with that same process.

A big part of that process for folks who have a job and a side hustle, is keeping track of their side hustle taxes. If you calculate these wrong or don’t pay them at all, you could end up owing a chunk in fees come tax filing time.

It’s a good thing that tools exist to help you calculate these correctly and automatically throughout the year, so you don’t have any unfortunate surprises. Before we get into the best side hustle tax calculator to use, let’s first aim to understand side hustle taxes and what they entail.

Table of Contents

What taxes do you pay on side hustle income?

At a day job, your employer withholds taxes for you depending on what you select on your W-4 form. When it’s your self-employed income earned from a side hustle, it’s a little different. There is no W-4 involved and you’ll need to keep track of the taxes you’ll owe on your own.

The taxes that you’re responsible for on side hustle income are self-employment tax, federal and state income tax, and any additional taxes your state might require like sales tax.

Breaking Down Side Hustle Taxes

Self-employment tax consists of a 12.4% for Social Security tax on up to $160,200 of your net earnings, and another 2.9% for Medicare tax on your full net earned income. You actually already pay a portion of this at your job, with your employer covering the other portion. When you have a chunk of income entirely from self-employment – like a side hustle – you’re responsible for paying both the employee and employer portions on that income- totaling 15.3%.

Self-employment taxes aren’t calculated off the entire income though. They are calculated from the profit you make from your side business. Profit is calculated by subtracting business expenses from your business income. However, income taxes are figured from your entire income.

The IRS recommends you pay both your self-employment & income tax owed in quarterly installments called estimated taxes. If you don’t calculate these correctly or fail to pay them, the IRS could charge you penalties.

This use to stress me out so much each quarter when it came time to pay up. That was until I found the perfect tool to automatically calculate and track these for me called Lunafi.

As you’re reading through my experience with the app, you can get started with a free trial and use the code DABBLE that Lunafi was so kind to provide my readers for 40% off a yearly subscription – which is about the price of a Starbucks order that you get to write off as a business expense 😉

Reviewing Lunafi’s Side Hustle Tax Calculator

Lunafi is an app that has one of the best side hustle tax calculators I’ve used. I’ve started to use the app recently to help keep track of my own side hustle finances, and to make sure I was setting enough aside for taxes. Now, I’ll continue to use it to help me track my taxes for the current year.

Before using the app, I was following the 25% – 30% rule for setting aside taxes for my business. I also have an accountant that is lovely enough to send me quarterly reminders for when to pay my estimated taxes and how much to pay.

While my guesstimations worked alright, I either found myself setting aside too much or too little when I got those email reminders from my accountant. We also track all of those numbers in a shared bookkeeping system but it doesn’t have a very friendly mobile version. Using an additional tool like Lunafi has helped my own organization around taxes ten-fold.

From just glancing at the app every month, I can better plan for taxes and set aside the necessary amounts in my high yield savings account until it comes time to pay those.

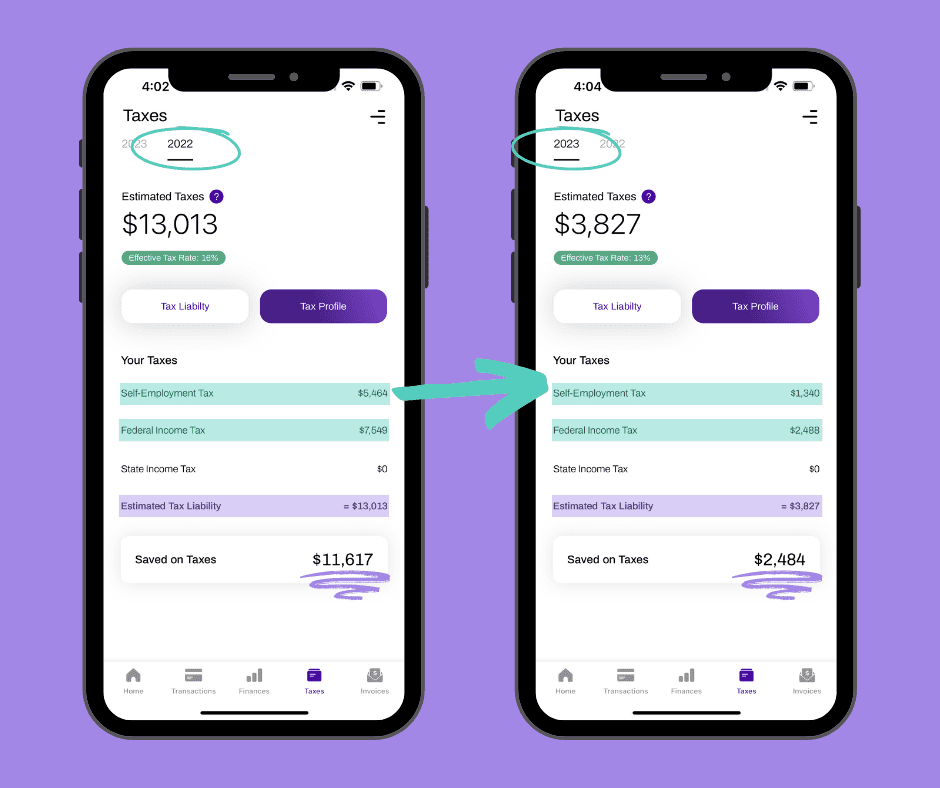

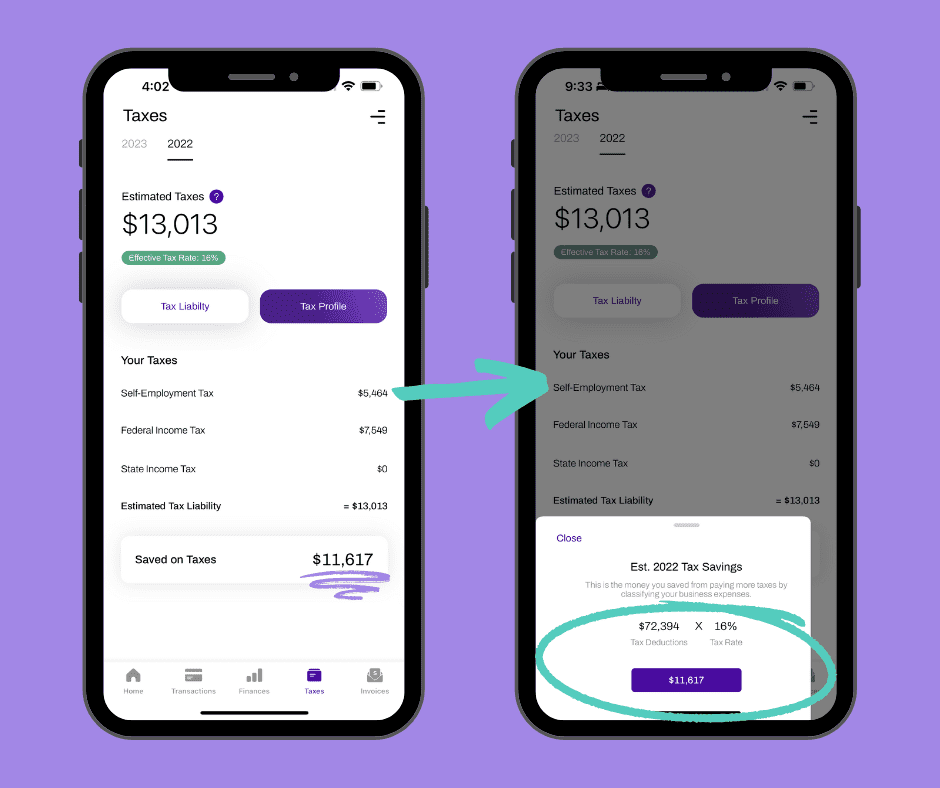

To get a better idea of what I mean, refer to this snapshot from Lunafi of what my 2022 taxes look like, and next to that is how my 2023 taxes are measuring up so far:

What is Lunafi?

Lunafi is a IOS mobile app that helps side hustlers track income, expenses, and taxes from multiple income streams. It’s perfect for this because it doesn’t only account your business finances to determine your tax liability, tax rates, and tax savings.

Lunafi also accounts for your W-2 income, in addition to 1099 income, so it can look at your overall finances and taxes.

The Easiest Way to Use Lunafi

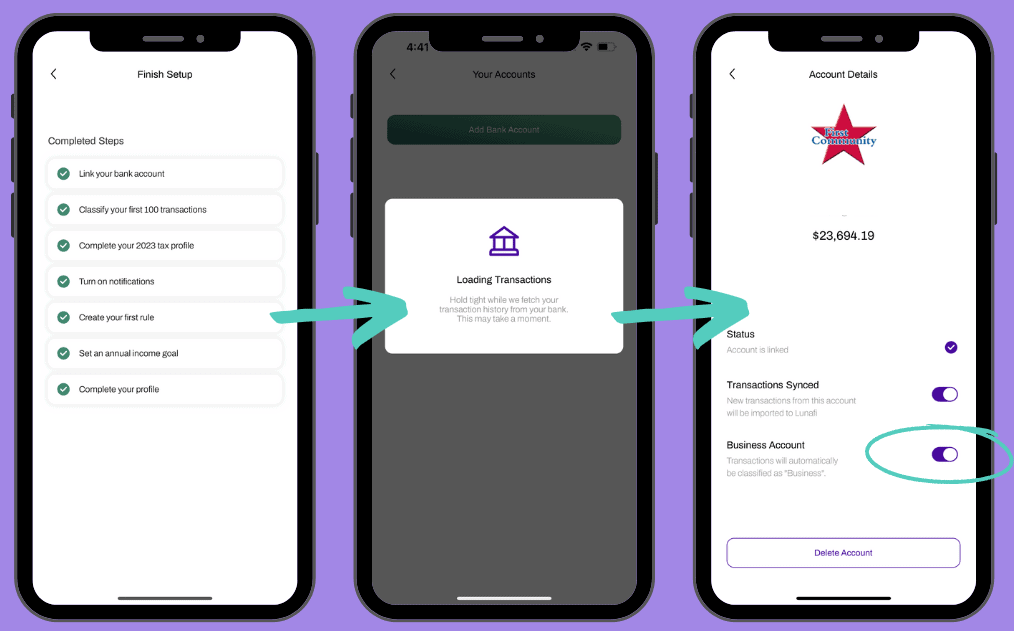

How it works is after downloading the app and creating your account, you’ll have a list of to-do items to complete to make sure you’re getting the most out of the app. If you don’t complete the setup list, the app won’t be able to give you accurate calculations.

The setup list contains action items like linking relevant bank accounts, classifying transactions, creating rules when classifying transactions, completing your tax profile, setting income goals, and more.

Since my W-2 income is in my personal bank account while all of my business finances are in my business bank account, I linked both to the app. After loading transactions, I found the easiest way to start classifying them was to first classify my business bank account as “Business” because without that checked, it would throw off the total calculations.

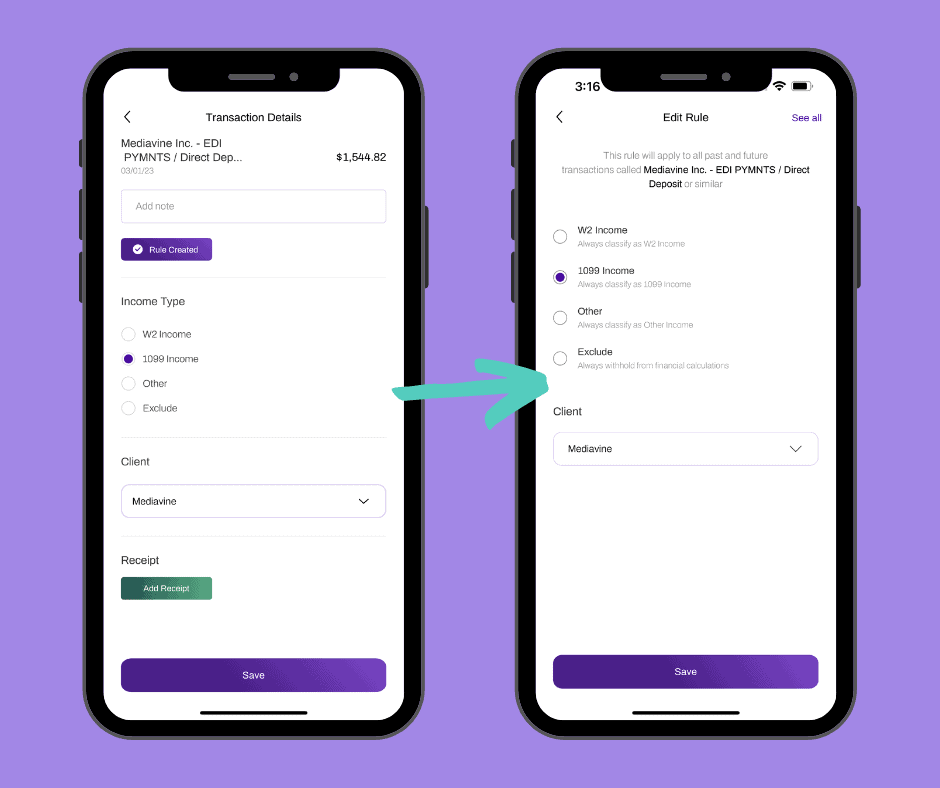

Then from there, I started classifying my transactions. I quickly realized that classifying each transaction individually was going to take me hours. I instead jumped to creating rules to bulk classify chunks of transactions. I started creating rules for my W-2 income first since those were the simplest and took a matter of minutes.

Then I proceeded to 1099 income, then business expenses, and finally my personal expenses. This cut the entire process down to 1 total hour to classify all of my 2022 transactions and 2 months of 2023 transactions. Then from there, Lunafi automates the rest for me so I can track my finances stress-free throughout the rest of the year.

If you end up using this tool, I definitely recommend classifying all of your transactions using rules.

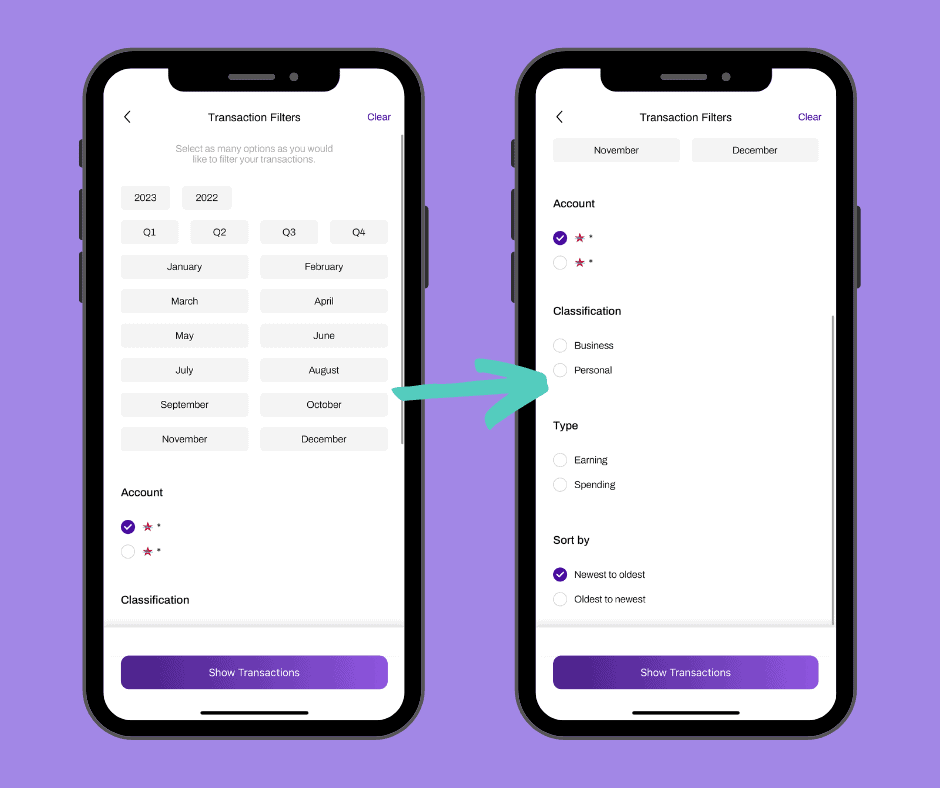

I also used the transactions user interface in Lunafi to tweak the different filters as I was creating different rules. Being able to analyze the data as I was classifying transactions and creating rules, was like candy to my neurodivergent ADHD brain. Doing it this way helped me stay organized through the process and make sure I was classifying transactions correctly, especially their tax categories.

As I track throughout the year, I may have to change some rules and create new ones. This isn’t a big deal since the app does such a great job of simplifying this process.

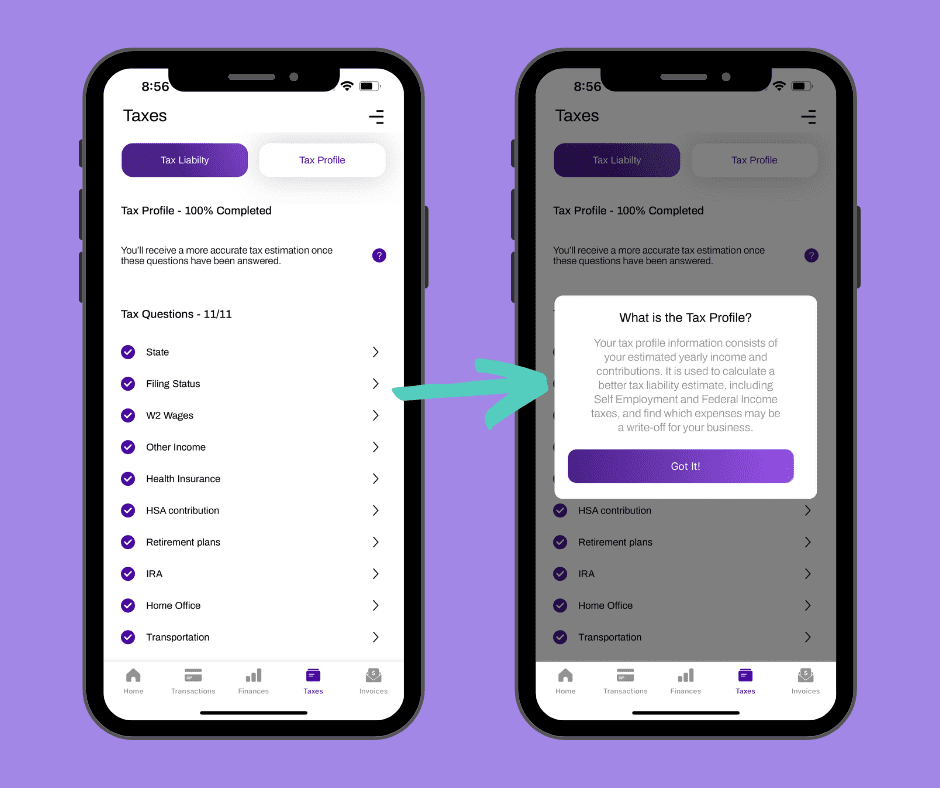

Setting Up a Tax Profile

Lunafi uses tax profiles to gather estimated income and contributions per year. It’s the heart of the automated tax calculations it provides.

I first filled out my tax profile information for 2022 because I had just recently received my W-2 and series of 1099 forms that had a lot of the information needed for my tax profile. My 2023 tax profile looks a little different since leaving my W-2 job in 2022, so I had to guestimate on some of the questions.

Lunafi’s tax profiles for each year includes standard tax-related questions such as checking for any state income tax liability, your filing status, W-2 wages and wages from other income, health insurance information, HSA contributions, retirement plans, and IRA contributions. If you’ve ever used any sort of tax software in the past, you’ve seen several of these questions before.

There is also a question that asks for home office information for folks who work from home. Lunafi uses this information to tell you how much you can write-off for that space. For me, I use 200 sq ft of our home for a home office and am able to write off a portion of my mortgage payments. If you use a car for your side hustle, you might also be able to write-off some of your transportation expenses.

Lunafi uses the tax profile to calculate a more accurate tax liability estimate while showing you what you can write-off for your business – saving side hustlers thousands in taxes. After I completed my tax profile, I saw the tax amounts for that year automatically update with a savings of over $11,000.

Once all of your transactions are classified with rules and your tax profile is set up correctly for the year you’re tracking, the app is pretty much automated from there.

You should review it monthly for any new transactions you have to categorize. Especially when it comes time to pay your estimated taxes for that quarter.

Get Tax Info Per Invoice

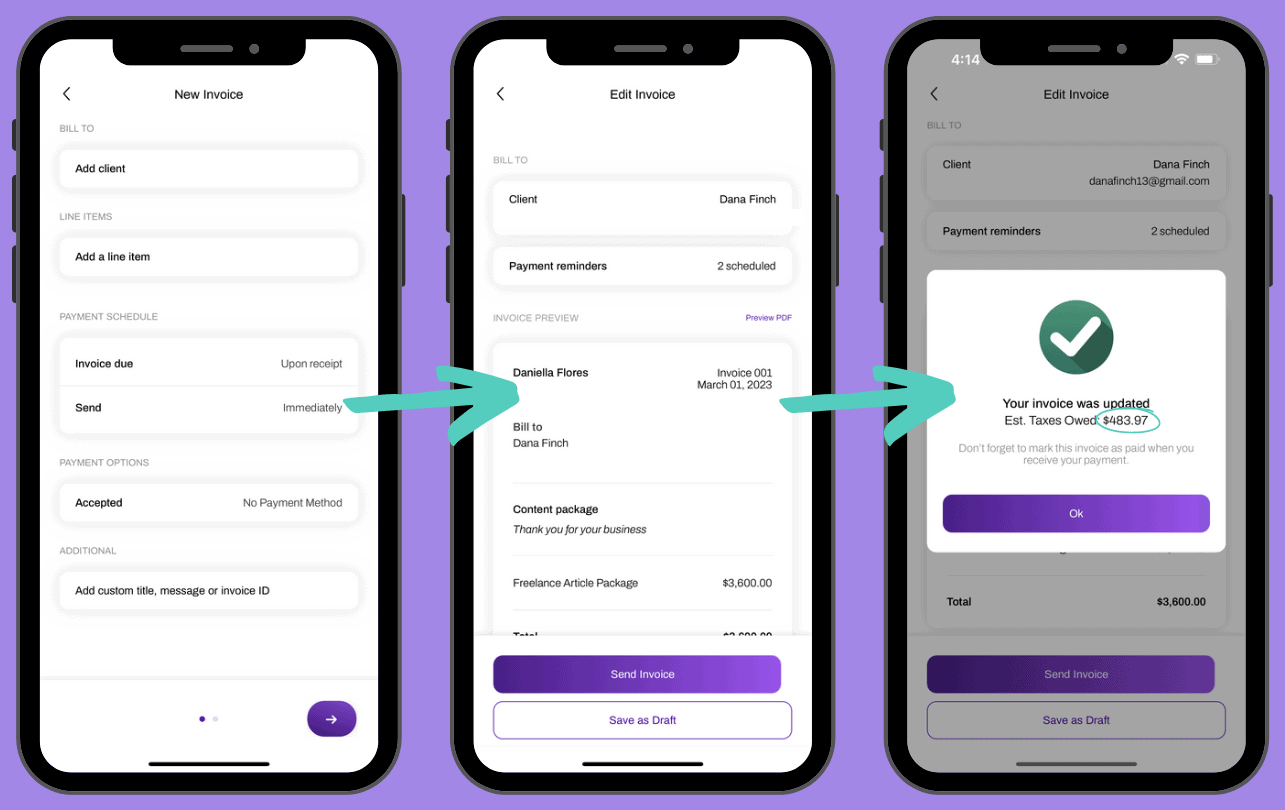

An added plus to Lunafi is that you can also invoice clients for your services directly through the app, and accept payments too.

Invoicing clients has always been a sort of clunky process for me, at least in the beginning. I have a good grip on it now, but am still lacking in the follow-up housekeeping items – like setting aside taxes from each invoice payment.

It’s pretty cool that Lunafi shows you the taxes owed right as you send the invoice, and that information will remain in the tool if you need to refer to it later.

Lunafi Review: Try It Out For Yourself

Lunafi is such a beneficial app for side hustlers. It really takes away the confusion and stress that comes with taxes and tracking multiple income streams. It’s also much easier to use than most of the more well-known financial tracking apps, automates literally everything, and with a much shorter learning curve.

I especially love the reporting feature that allows me to export a Profit & Loss statement to file with my taxes. That was something that would take me almost a whole day to generate with a year’s worth of financial data while trying to use clunky tools. I did it on Lunafi in 1 hour and next year when I pull it, I’ll be able to do so instantly because I’ll be tracking all year long with the tool.

If you’ve been looking for a tool to simplify your side hustle taxes and finances, use it with us! Try it out and let us know what you think.

Get started with a free trial, then use the code DABBLE that Lunafi was so kind to provide my readers for 40% off a yearly subscription – which is about the price of a Starbucks order that you get to write off as a business expense 😉

Disclaimer: I am not an accountant and this isn’t professional tax advice. I recommend you consult with a professional accountant while filing your taxes.

You might like these other posts about side hustles:

- 22 Remote Side Hustles That Can Be Done From Anywhere

- How to Set Your Freelance Rate

- How to Create a Portfolio

- What is a Portfolio Career & How to Build One

- Best Remote Careers for Folks With ADHD

Pin it for later!

Daniella is the creator and author of iliketodabble.com. When their wife Alexandra and them aren’t globetrotting or playing with their 7+ animals, they are dabbling and working towards a future of financial freedom.