Our website is supported by our users and contains affiliate links. We get paid when you purchase or sign up for anything through those links. Read the full disclaimer for more information.

Last Updated on February 6, 2023 by Daniella

Joining the world of investing can seem like a momentous task.

When you start learning how to get started investing, you’ll have to decide what types of funds you want to invest in, if you want to hire an advisor and more.

Fortunately, when you have an easy-to-use app like M1 Finance to help you get started, investing can be a breeze.

Table of Contents

What is M1 Finance?

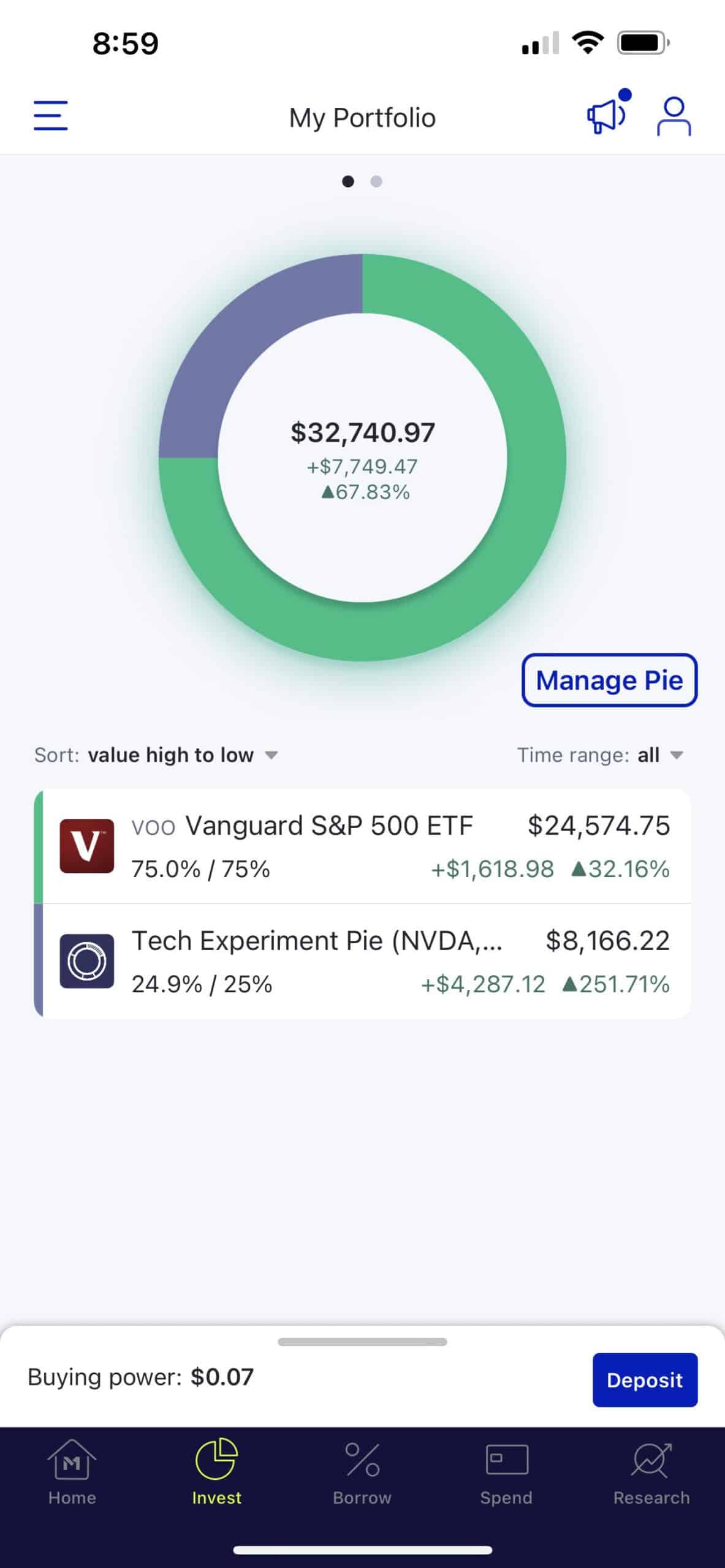

M1 Finance is an automated investing platform that allows users to distribute their funds into different allocations. They use what is called ‘pie investing’, or a unique mix of stocks, bonds, and Exchange Trade Funds (ETFs) based on your risk tolerance. Each of those categories makes up a piece of the overall ‘pie’ of your total investment portfolio.

Users can sign up for M1 Finance to help them invest and manage their investments on an ongoing basis. The platform is free to use, so users can choose to do self-managed investing or to use robo-directed investing.

M1 Finance is available via their app or you can choose to use the platform on a browser. It allows a high level of customization and users can tailor their portfolios based on how long-term their focus is, how high their risk tolerance is, and how much control they want to have over their investment portfolios.

Is M1 Finance Legit?

Over 150,000 people have signed up to use M1 Finance and use the pie features to help them allocate their investments. The app has over 14,000 five-star ratings in the app store. Overall, this company is both legitimate and highly regarded in the industry.

How to Use M1 Finance

Getting started with M1 Finance is a simple process. Once you have an account, you can add investments and move your money around as you deem necessary.

Getting Started

The first step to using M1 Finance is to set up a profile. You must simply enter your email address and choose a password to get started. Once you’ve created your profile, you can start building your pie. It is important to note that no risk assessment recommends a pie allocation for you within the M1 Finance platform, so you may want to do some research to decide how you’d like to allocate the different parts of your pie at this stage.

You can also choose a pre-built pie at this stage and begin to customize it. Once you’ve built a pie, you can enter your personal information and link a bank account to fund your M1 profile. If you choose a pre-built pie, you can choose from the following categories:

- General investing – Based on your risk tolerance, you can choose from these diversified portfolios.

- Retirement planning – If you want your portfolio to be centered around a target retirement date, you should evaluate the allocations in this category.

- Responsible investing – If social responsibility is important to you, these options focus on sustainable companies.

- Income earners – These portfolios are centered around dividends and income returns.

- Hedge fund follower – The options in this category mimic investment strategies from the most prominent investors and hedge funds.

- Industries and sectors – If you want to invest in a specific market, look here.

- Just stocks and bonds – You can still diversify by just using stocks and bonds. This category will help you find the right mix for your goals.

- Other strategies – Looking for something different? This ‘miscellaneous’ category allows users to evaluate other strategies that work for you.

Ongoing

Once you’ve set up your pie, you can continue to customize it. You can simply select the ETF, stock, or bond that you want to add, then save the changes. It then forms your new investment mix moving forward. You can also create multiple pies for different investing goals that you may have. You can have an unlimited number of pies in your account.

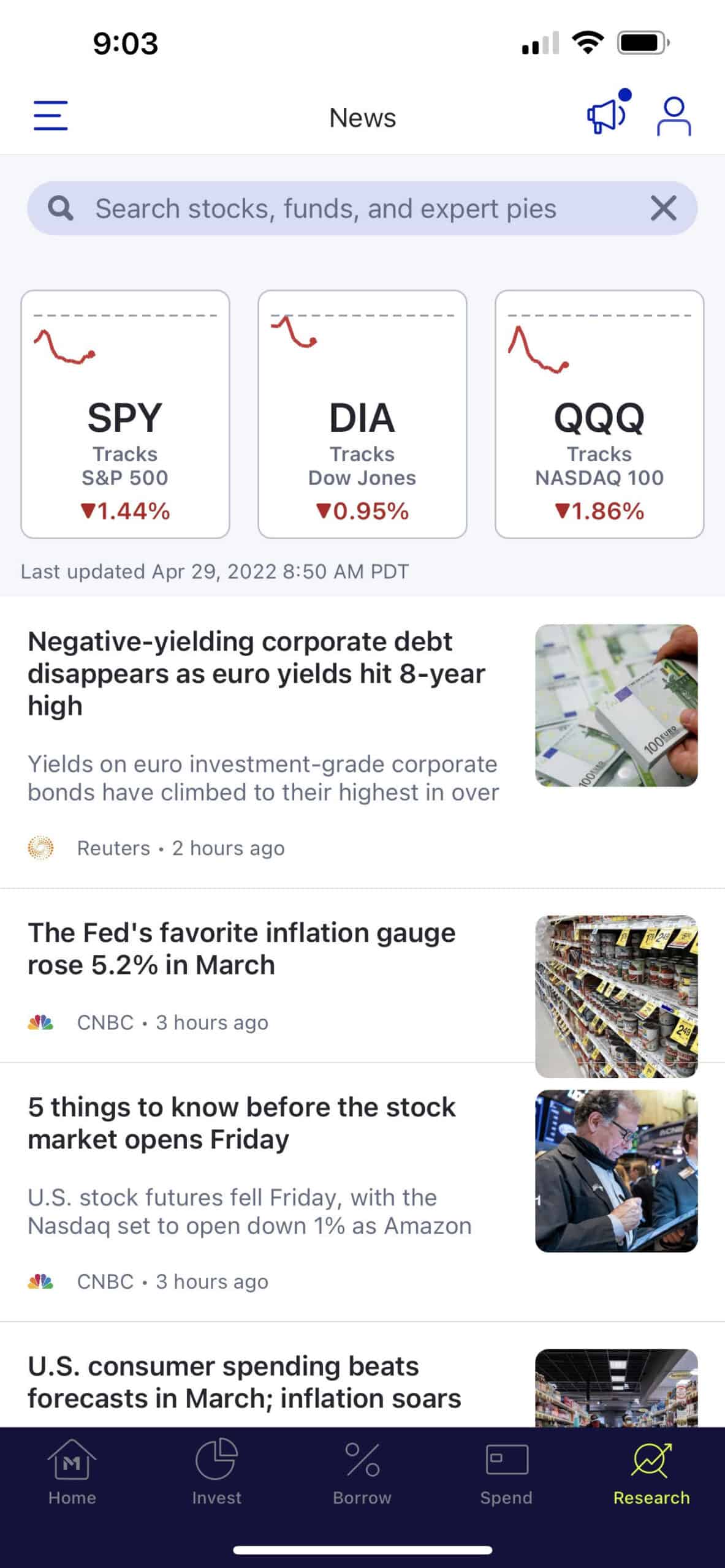

Research & Watchlist

You can use the research tab of the M1 Finance app to research specific stocks you want to look at.

Add stocks to your watchlist and continue to watch them overtime. When you want to decide to add them to your pie, you can pick them from your watchlist.

Add Pies to Your Profile

When you add pies to your profile, you will decide how much of your money will go into each slice of each pie. For example, if you have one pie and 50% of it is stocks, then 50% of the money added to your account each month will go to stocks. If you decide to create a custom pie with 4 stocks, you can allocate 25% of your money toward each stock.

As you continue to add money to your investments, you will be able to access your portfolio from the app or a desktop. The app has all the functionality of the desktop platform. Within the app, you will have access to a native newsfeed to browse market news and see the latest updates. You will also be able to schedule transfers from your bank and automate monthly, weekly, or annual contributions to your investment portfolio.

Should I Use M1 Finance?

The decision to invest and which platform to use always comes down to your needs and goals. However, there are plenty of things that make M1 Finance a top option for those looking to use an automated investment platform.

Pros

Experienced investors will especially appreciate M1 Finance due to the high level of customization that you can incorporate into your portfolio, especially for those that are just beginning their investment journey. Other advantages to using this platform include:

- It is free – The M1 finance platform is completely free to use. There are no brokerage fees, commissions, or hidden fees. Additionally, there are no management fees, so the transparency about how the platform gains revenue is evident.

- No minimum deposits – You can open your account without making any investments, then begin investing as you can permitting that you have at least $100 in your account. Then, all your incremental additions are automatically distributed based on how you’ve set up your pie(s).

- Freedom of choice – You can select your investments. Once you’ve set up your investments, your portfolio will be automatically managed. You can also choose from over 80 ‘expert’ portfolios and follow the guidelines of experts who invested before you.

- No trading fees or commissions – There is no additional fee for buying or selling the securities within each pie that you create.

- No cash investments – Your account will not retain cash. Instead, as you contribute to your account, anything over $10 will be automatically invested. Additionally, you can trade fractions of shares, so your money is always fully invested.

- Easy to use – The dashboard allows for easy-to-read visuals to help you understand the composition of your portfolio, and the app and website make trading, changes, and simpler for any investor.

Cons

While the platform is easy to use and has plenty of things to appreciate, there are a few things that some users should consider before using M1 Finance.

- Trade timing – Trades are placed during the New York Stock Exchange operating hours. This means that stock, bond, or ETF prices can change between when you place your order and when they are purchased, otherwise leaving transaction timing out of your control.

- Fees for non-use – If you start an account with less than $20 and do not do any trading in a 90-day window, you will be charged a fee. This is easy to avoid if you are actively using your account.

- Support – There is no online chat capability. This is popular amongst online advisors, robo-advisors, and other similar platforms, so it may be a setback for an investor who prefers real-time support.

- Not an advisory firm – M1 Finance makes it clear to users that it is an investment platform, not an advisory platform. Therefore, if you are looking for the help of financial advisors, you should look elsewhere. However, you can work with an advisor independently to help you build your portfolio if you do want to use an advisor and M1 Finance.

- No goal-setting – The platform does not have a risk calculator or goal-setting tool. If you are already aware of your goals and your risk tolerance, then using M1 Finance might be great for you. However, if you need extra help, M1 Finance will not help you determine your goals and risk tolerance.

- No external accounts – This platform does not offer to users the option to consolidate external accounts. This can be especially helpful when planning your finances. Therefore, if you plan to evaluate your portfolio against your employer-sponsored 401(k) or other investments, you will have to do all the calculations outside of the M1 Finance platform.

- No tax-loss harvesting – Many rob- advisors offer this option, but M1 Finance does not offer tax-loss harvesting.

- No mutual funds – If you want your portfolio to include mutual funds, then you will have to look elsewhere. The platform only offers ETFs, stocks, and bonds.

The Bottom Line

What sets M1 Finance apart from other automatic investing platforms is the pie feature. It gives users an easy-to-use visual representation of their investments and allows users to easily add money to their investment portfolio and make changes to their investment mix when needed. However, the lack of a goal-setting feature and lack of compatibility with other investment platforms may be a deterrent for some users.

Have you gotten started investing in stocks yet? Let us know in the comments if this was helpful or not and give this app a try (there are no fees and it’s completely free to use)!

More reviews:

- Qapital Review: The Rule-Based Automated Savings App

- Clarity Money Review: The All-in-One Money App

- Rakuten Review: There is No Such Thing as Free Money

- VIPKID Reviews: Everything You Need to Know

- Mistplay Review: Can You Really Make Money Online Playing Games?

- FlexJobs Review: Is It Worth The Price?

Pin it for later!